closed end credit def

Occasionally you might have closed-end credit with a variable interest rate. A closed-end mortgage loan or an open-end line of credit may be used for multiple purposes.

The repayment includes all the interests and financial charges agreed at the signing of the credit agreement.

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

. Full payment includes amount advanced interest and. In closed-end credit facility credit proceeds must be paid in full on closing credit arrangement. Since the lender is relying on these monthly interest payments your loan term may include prepayment penalties.

With a closed-end loan you borrow a specific. For example a closed-end mortgage loan that is a home improvement loan under 10032i may also be a refinancing under 10032p if the transaction is a cash-out refinancing and the funds will be used to improve a home. Closed-end credit is a type of credit that should be repaid in full amount by the end of the term by a specified date.

Your house or car are purchased using closed-end credit which is credit that must be paid in full by a date certain. The interest rate and minimum monthly payment on credit cards can vary. With no annual.

If the borrower does negotiate a modification of the loan the borrower will be subject to penalties as determined by the lender. There is often confusion between an open-end credit and a closed one. For example in an automotive loan the lender might extend credit for five years.

It remains open and it permits the lender to make advances on the loan that are secured by the original mortgage. A credit arrangement to be paid in full by a specified date is closed end credit. Closed-end credits include all kinds of mortgage lending and car loans Types.

An agreement in which advanced credit plus any finance charges are expected to be repaid in full over a. Open-end credit is defined as credit extended under a plan in which. In other words an open-end mortgage allows the borrower to increase the amount.

Closed end credit is a type of loan which entails a fixed amount of funds sometimes for a specific purpose. For instance if you take out a car loan or a real estate loan youll be given a set amount of money with a particular repayment schedule. Closed-End Credit Law and Legal Definition.

Closed-end loan is a legal term applying to loans that cannot be modified by the borrower. And 3The amount of. 1The creditor reasonably contemplates repeated transactions.

Once the funds have been transferred to the borrower they must be paid back entirely to satisfy the terms of the borrowing agreement and conclude. A loan agreement in which the lender expects the entirety of the loan including principal interest and other charges to be paid in full by a stated due date. In contrast a closed-end credit is when one requests a lender to.

A closed-end fund legally known as a closed-end investment company is one of three basic types of investment companies The two other types of investment companies are open-end funds usually mutual funds and unit investments trusts UITs. Closed-End Credit Law and Legal Definition. Most credit cards are unsecured meaning no deposit or collateral are required secured cards require a security deposit that typically becomes the cards credit limit.

Adjective having a fixed capitalization of shares that are traded on the market at prices determined by the operation of the law of supply and demand compare open-end. With closed end credit you agree to a monthly payment that youll make until the end of the loan term. Exchange-traded funds ETFs are generally also structured as open-end funds but can be structured as.

The borrower must completely satisfy the terms of the loan in that period of time. This loan must be paid including interest and financial charges within a stipulated period. To understand it better a line of credit as used in the definition is a pre-approved amount of money that is extended by a lender and goes into a borrowers special account to be drawn on a need basis.

An open-end mortgage allows individuals to borrow additional money on the same loan at a later date without having to take out new financing or credit. 2The creditor may impose a finance charge from time to time on an outstanding unpaid balance. With closed end credit when you originally apply for a loan with the lender the terms never change.

The borrower must completely satisfy the terms of the loan in that period of time. The positive side of closed-end credit is it offers predictability and stability. Unlike a credit card which is an excellent example of an open-end loan closed-end loans do not allow borrowers to continually access new funds when they have paid back a portion of the original borrowed amount.

To better understand open-end credit it helps to know what closed-end credit means. Closed End Credit is defined 2262 as credit other than open-end credit. Specifically the borrower cannot change the number or amount of installments the maturity date and the credit terms.

This payment includes interest and principal which slowly decreases your loan balance until its satisfied. For example in an automotive loan the lender might extend credit for five years. A loan agreement in which the lender expects the entirety of the loan including principal interest and other charges to be paid in full by a stated due date.

Credit Scoring Fico Vantagescore Other Models

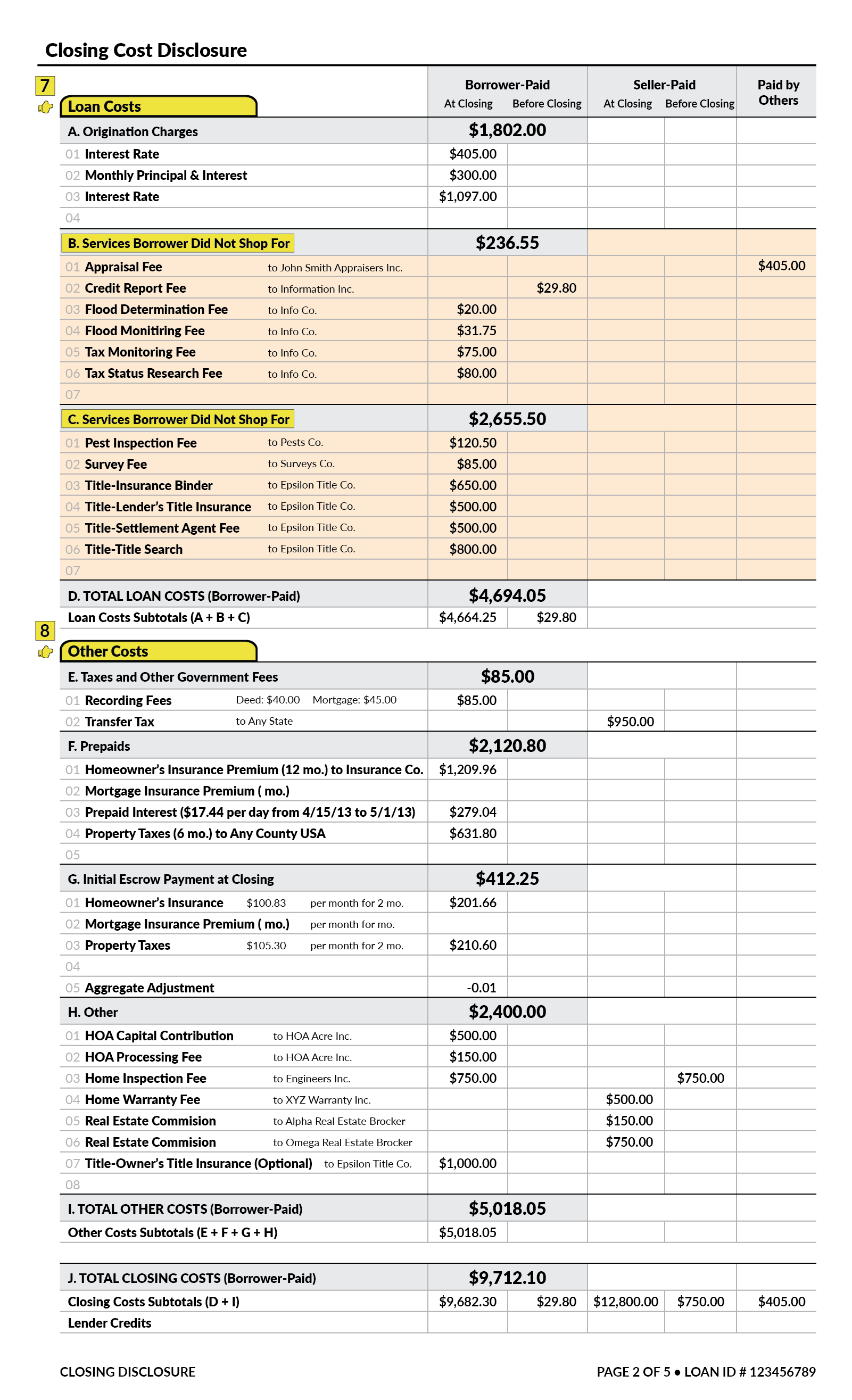

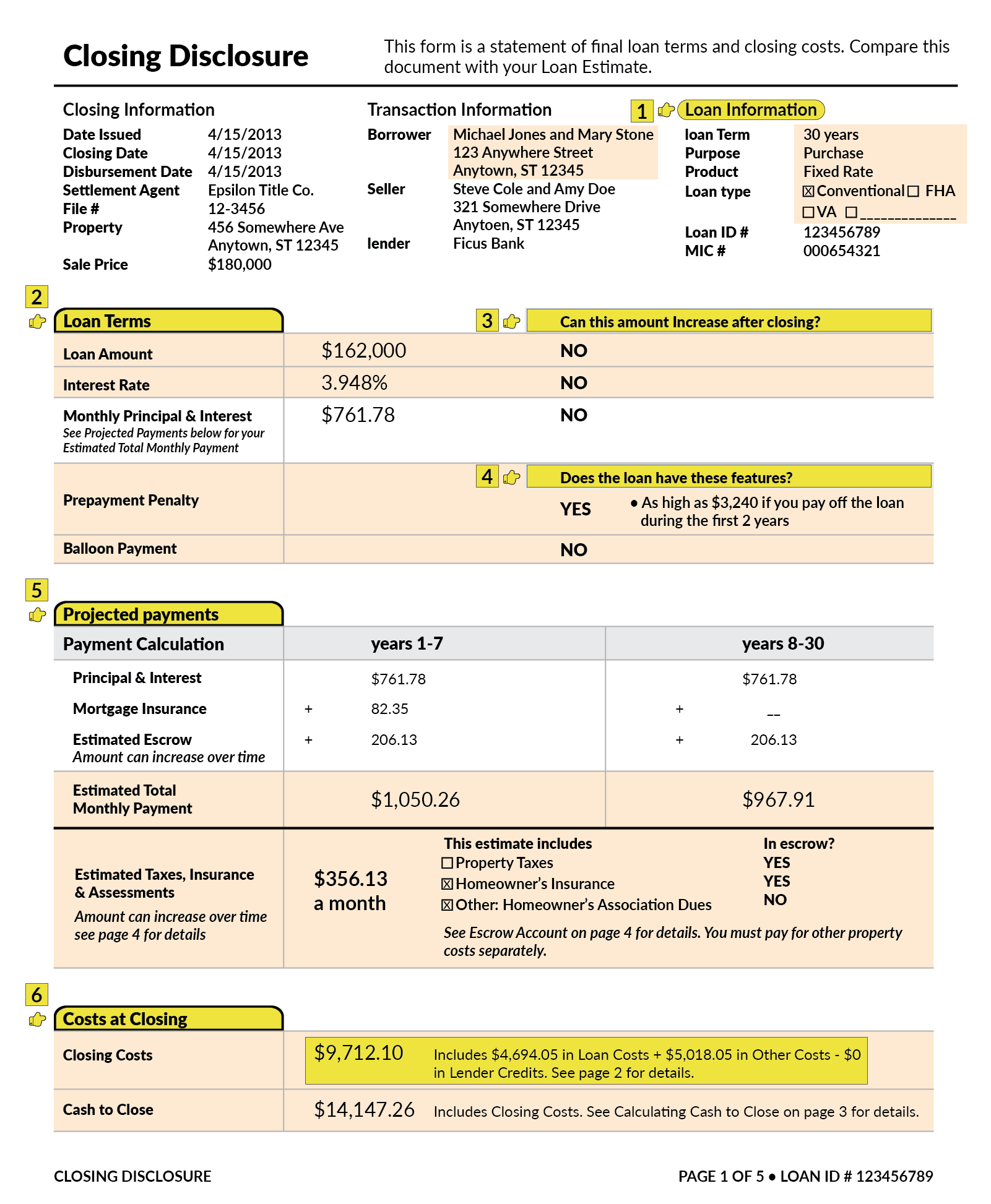

What Is A Closing Disclosure Lendingtree

What Is A Closed End Fund And Should You Invest In One Nerdwallet

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

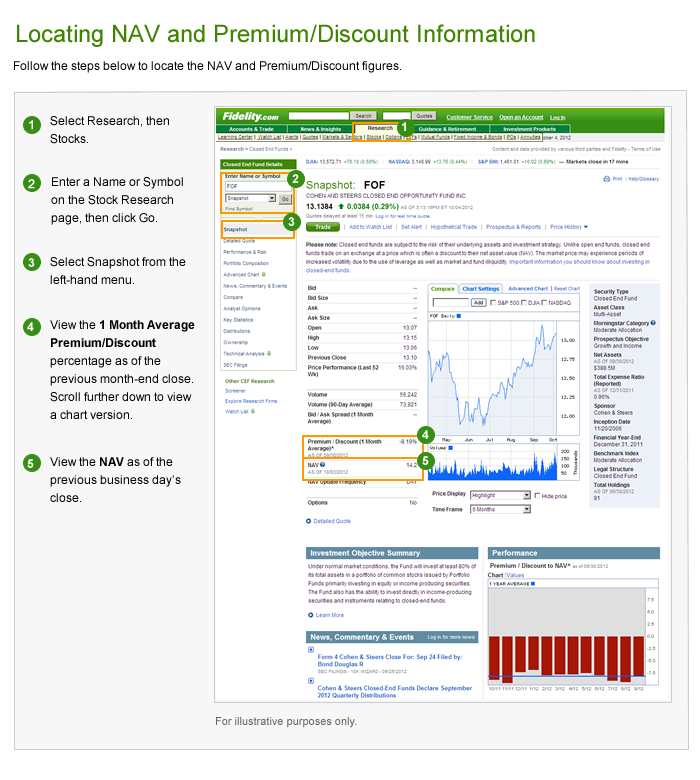

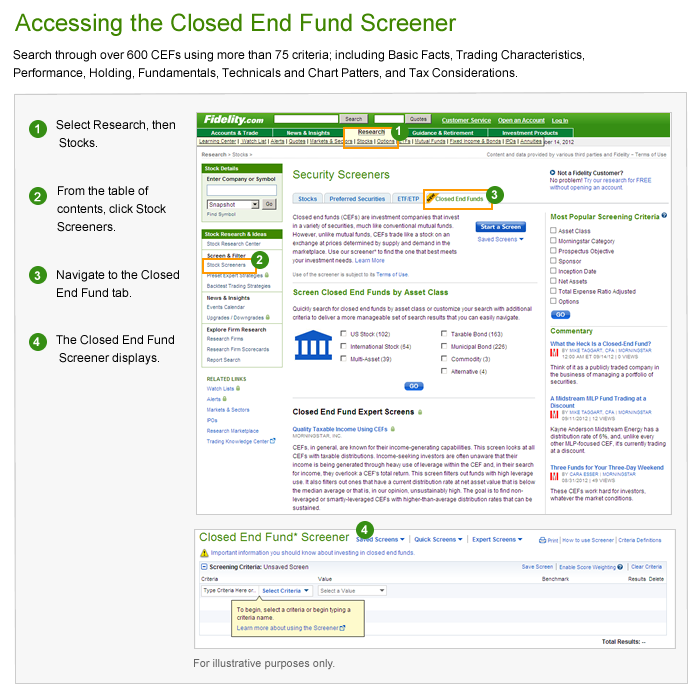

What Are Closed End Funds Fidelity

What Are Closed End Funds Forbes Advisor

What Is Open End Credit Experian

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Truth In Lending Act Tila Consumer Rights Protections

/close-up-of-credit-cards-580502979-3998b1e8a9d242c98648cc04ce236e8b.jpg)

Line Of Credit Loc Definition Types And Examples

Closed End Fund Cef Vs Exchange Traded Fund Etf Study Com

What Is A Closing Disclosure Lendingtree

Understanding Finance Charges For Closed End Credit

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)